Previously, personal loan applications were lengthy and inconvenient, requiring document submission, phone verification, manual review, approval, and an in-person visit to sign - often taking several days and discouraging use. Yuanta Bank identified key challenges:

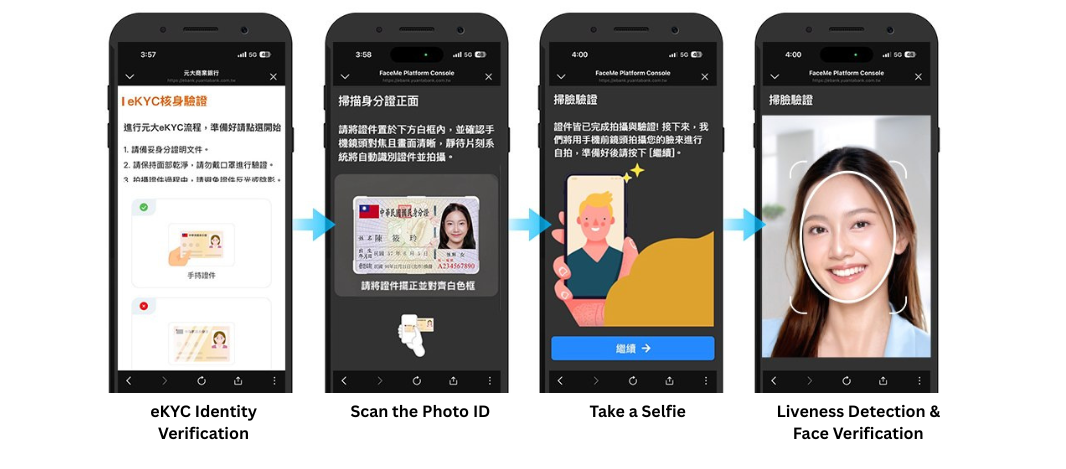

Yuanta Bank’s “Vitality Cycle Loan” uses CyberLink’s FaceMe® eKYC to enable seamless mobile loan applications. The system combines face-to-ID matching, document authenticity checks, liveness detection, and AI OCR for accurate text capture. Customers can apply entirely online via Yuanta Bank’s site or app and receive approval in as little as 15 minutes - no branch visits or calls needed. This streamlined process offers faster, more convenient borrowing, especially for urgent needs, while AI - driven verification boosts accuracy and security, reducing identity fraud and forgery risks.

Comprehensive Capabilities – FaceMe® offers facial recognition, face-to-ID matching, document verification, liveness detection, and AI OCR, meeting Yuanta Bank’s end-to-end eKYC needs.

High Accuracy – In the latest NIST FATE evaluation, FaceMe® achieved 99.83% recognition accuracy and a false acceptance rate of 1 in a million, trusted by top financial institutions.

Certified Anti-Spoofing – iBeta PAD Level 2 certified and ranked #1 in NIST PAD tests, FaceMe® blocks spoofing via photos, videos, and other fraudulent biometrics.

AI OCR – Optimized for Taiwan’s IDs, driver’s licenses, NHI cards, and permits, it captures clear images, extracts key data, and accelerates verification.

Modular Design – Supports Yuanta’s app and web platforms with scalability for future paperless services like online account opening.