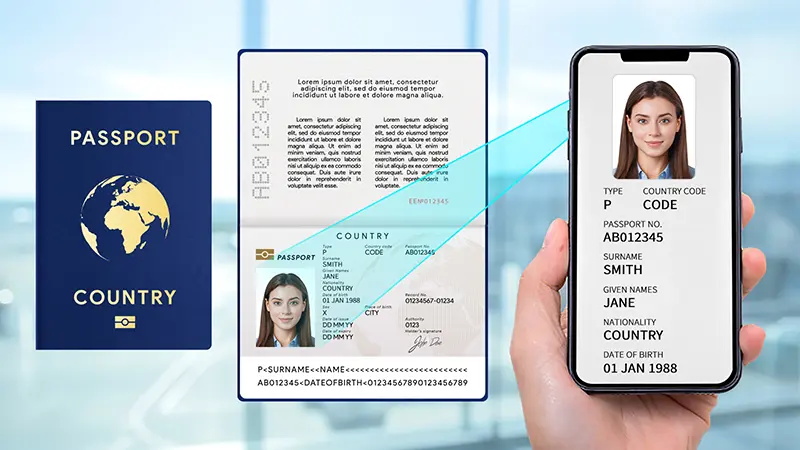

Using advanced facial recognition, FaceMe completes 1:1 face-to-ID verification in just three simple steps. Customers scan their photo ID, take a live selfie on their mobile device, tablet, or computer, and AI technology performs liveness detection and anti-spoofing checks to confirm authenticity. Once verified, the facial recognition engine performs a 1:1 comparison between the individual and the scanned ID for fast, secure identity confirmation.

FaceMe® eKYC features an adaptable modular design, enabling businesses to build and scale eKYC workflows tailored to their unique needs.

Deploy on-premises

Deploy in the cloud

iOS and Android apps

Web browsers

Overview of case review statuses

Case-by-case results

FaceMe® eKYC identity verification supports a wide range of applications, including in-person account opening, cardless ATM transactions, online banking, and insurance enrollment. Powered by advanced facial recognition, it delivers faster identity verification, secure login, and reliable transaction confirmation.

Online Account Opening

Loan Applications

Remote Insurance Services

Online Service Activation

Cryptocurrency Account Opening

Government Service